Editor’s note: This is the second in a three-part series exploring how digital inkjet printing is transforming the packaging industry.

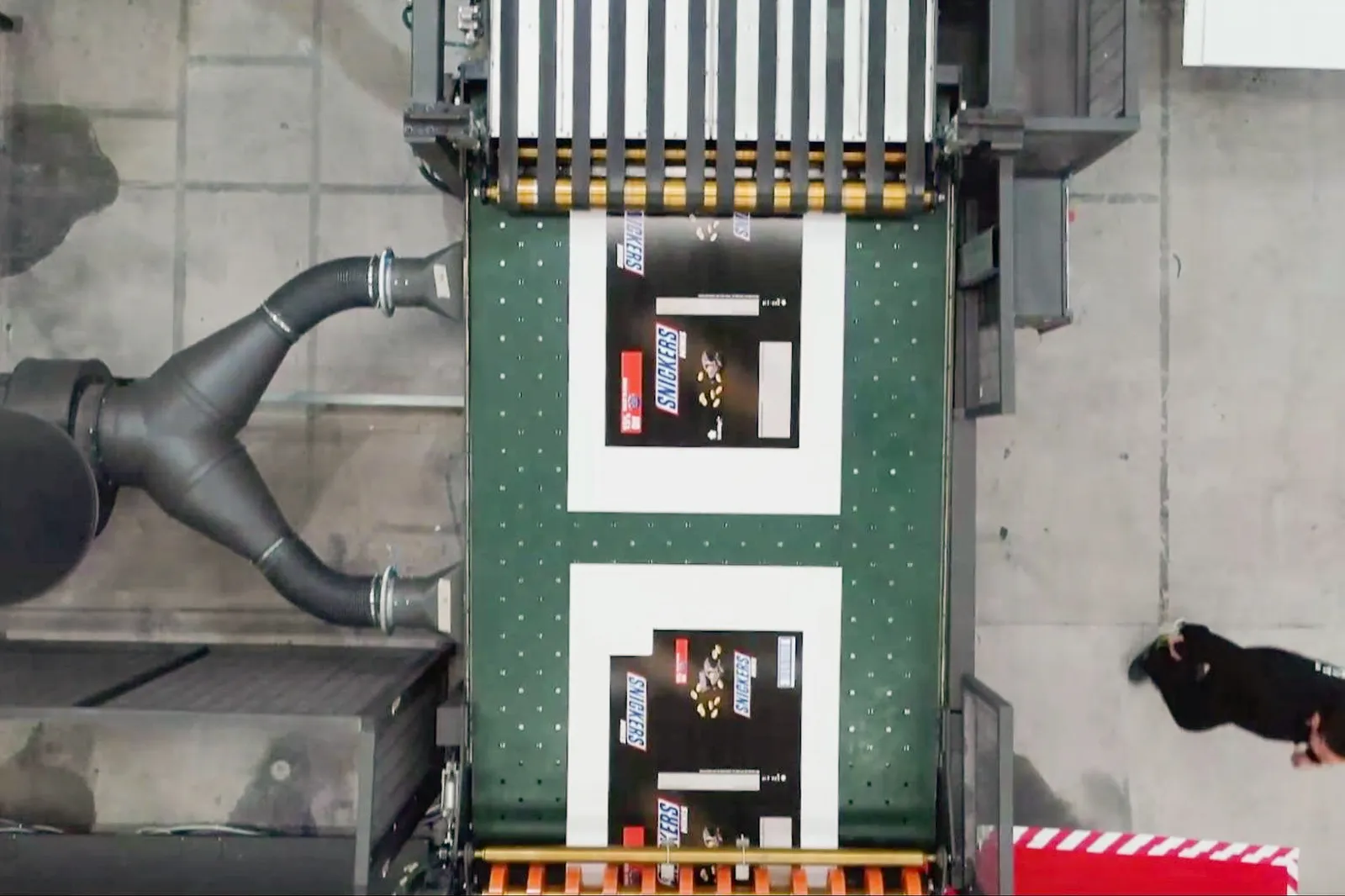

Each day, millions of e-commerce boxes ship nationwide. In some cases, consumers see bright imagery outside and inside the box, and their packaging might vary from others who received the same product in a different part of the country.

Demand for these differentiation possibilities and other unique features is booming, prompting more packaging companies for substrates including fiber, plastic and glass to invest in digital inkjet printing technologies to fulfill customers' evolving desires — and do so economically. Even though converters are OEMs' target audience, the technology's impact extends across the supply chain to brands, retailers and others who are beginning to request digitally printed packaging.

While digital printing has been used on labels for nearly 30 years, "in all the other [packaging] segments, digital is very new," said Jean Lloyd, a global principal analyst at Keypoint Intelligence. That being said, "everybody wants to get into packaging now because that's the absolute necessity, and that's where everybody sees the opportunity" for digital inkjet printing, she said. That's especially true with the movement toward direct-to-medium printing for reasons including waste reduction.

Learning curve

Given digital printing's fledgling existence in packaging — and manufacturers' ongoing efforts to improve the machinery and add features — converters continue to realize new advantages and applications. But that takes time.

"In 12 to 18 months you're going to start learning what you're doing, and it's probably 18 to 24 months before you really start being able to refine it and perfect what you do," said Rob Daniels, digital business manager at packaging company Fortis Solutions Group. "It's going to be six months to a year before you really start making money on digital."

He noted that at a previous job, "there were always issues around plates and tooling and prep costs" for analog label printing. Although the digital equipment's up-front cost initially presented a barrier, "slowly but surely we started winning accounts and we started getting orders from larger companies that were doing prototyping and R&D," he said. "Then it was like a light switch went on" and the economic gains prompted the company to upgrade to a new digital model every 18 months.

Similarly, Georgia-Pacific experimented with the technology for multiple years prior to launching its dedicated digital print service, Hummingbird, said Robert Seay, vice president of digital print strategy and growth. "Customers have found it provides them certain value: supply chain efficiencies, reduced inventory, faster turn time, reduced obsolescence."

During and after the pandemic, many early adopters of the technology found themselves at a unique advantage for managing topsy-turvy demand, supply chain upheavals and unpredictable inventories.

"The pandemic was crazy in packaging. It was absolutely nuts," Daniels said. But the ability to print limited quantities on demand with digital systems — instead of the usual minimums required for analog systems — allowed converters with this equipment to better manage their output and costs.

"During the entire COVID reign, nobody could predict the volumes of what they were going to need," Seay said. "Digital was perfect for that. ... We could do short-run quantities, put things out quick and follow up with more inventory as needed."

One of digital's most basic benefits is print job sharpness and overall quality compared with conventional plate-based printing systems.

"The print quality is fantastic," said William Barlow, market development manager at Printpack, which uses digital printing for flexible plastic packaging. "You can print finer, more detailed graphics with digital than you can with flexo or even gravure."

Another advantage for converters is that digital systems eliminate up-front processes for repeat orders. The time savings impact the bottom line.

"We would enter the order into our ERP system and it automatically would create a file that would bypass our pre-press, grab the file that is needed and start lining up on our digital presses," said Smith Lankford, general manager of the packaging division at printing and marketing solutions company Quad. "It basically eliminated the front-end process of getting files ready to manufacture that we go through on our traditional offset printing format or flexo printing format."

Building brand relationships

Incorporating digital printing capabilities helps converters level up their ability to meet customers' evolving needs.

"For packaging — all the segments — it's all about pleasing the brands and understanding what the brands are looking for and how things are changing," Keypoint's Lloyd said.

In addition to accelerating converters' operations, the technology facilitates brands bringing products to market faster.

"From the speed-to-market [standpoint], or just how accommodating it is with a minimum amount of spend and minimal amount of material ... it's positive, and we've received a lot of positive feedback," Printpack's Barlow said.

While packaging companies notice the advantages, so far most of their customers aren't tuned in enough to the technology to request it, sources said. But that's beginning to change. Some big brands are starting to "come to us and specifically call out digital for quality purposes," Daniels said.

Equipment and service supplier EFI is among the companies with a team of employees dedicated to working directly with brands to help them understand the value of digital printing on packaging, said Ken Hanulec, the company's vice president of worldwide marketing. Still, converters largely make the printing decisions and thus far mostly haven't actively promoted their own digital capabilities, said Jeff Wettersten, vice president of packaging at Keypoint Intelligence.

Quad's Lankford corroborated that point, explaining: "We don't have a lot of customers saying, 'Gee, I want my stuff to be printed digitally.' They just want their products to be printed and their brand to be consistent across the platform. So we use it more as a tool to meet what the customer's needs are with the most cost-effective manner we can."

Plus, "we can offer more creativity to our customers [with digital] than we do with traditional capabilities," said Melianthe Leeman, global marketing director for wine and spirits at O-I Glass. She described how O-I used digital inkjet equipment to help the Leonardo da Vinci winery launch its Monnalisa product line with graffiti decoration on the bottles.

"They also wanted to have this tactile effect that gets created when you layer graffiti. Digital printing, because we also layer inks, was the best way to do it — and also to match the colors that were in the initial artwork," she said. "While in silkscreen printing people are limited by the number of colors they can use, in this way of designing you can use as many colors as you want."

The on-demand nature of digital makes it superior to analog for cost-effective prototyping and design testing, sources said. “A brand can more efficiently do A/B testing with smaller orders of different packaging designs to find out what works best in different markets, thus minimizing waste,” said Pedro Gonçalves, Tetra Pak U.S. and Canada’s vice president of marketing.

OEMs and converters both say that at this point in time, digital inkjet printing is better suited for short runs than long ones, primarily from a cost and efficiency standpoint. However, for companies like Tetra Pak, "the option to print smaller batches has always been seen as a positive feature of the digital printer and never a limitation," Gonçalves said. Focusing on short runs allows smaller businesses to enter the game and become more competitive with larger companies: "It allows them to have entry-level packaging at a reasonable price that looks professional," Fortis' Daniels said.

Shelf appeal

Although e-commerce is a key area of opportunity for digital printing, use isn't limited to that space. The technology also boosts in-store retail packaging and can make it stand out from competitors'.

O-I Glass developed a feature to 3D print clear inks onto a bottle so the raised elements resemble embossing. Doing that makes "a stock bottle look like a completely proprietary design just by applying the digital printing capability" and provides brands with a differentiating feature, Leeman said. "That has been a big breakthrough."

The technology enables better flexibility with customer designs than offset lithography or flexography so a converter can produce multiple versions of the same package. This results in visually stunning on-shelf displays that draw in consumers, Gonçalves said, even to the extent of individual products' different designs lining up to show a unified message when arranged next to each other. He detailed Tetra Pak's work with Flow Beverage to print fiber cartons for the same product in different colors and designs as one example.

On-demand printing also enables quick adjustments to seasonal product inventories. "Lots of times, brands or retailers will find they have additional need that wasn't planned" when the seasonal printing initially occurred, Georgia-Pacific's Seay said. "Having inventory is expensive. Where you can do things more just-in-time, it not only gets rid of the obsolescence piece but also the cost of capital."

Converters also are harnessing the versioning concept to create different on-packaging designs for products distributed in a variety of regions, such as a brand's beverage cans displaying each region's home sports team. Customization and personalization in general are hot right now, sources said.

"It's no longer good that you have one bottle that is looking the same across the different geographies," said Leeman.

Creating consumer connections

Brands seek personalization more than ever to forge connections with consumers, build loyalty and influence future purchasing.

"Unboxing" experiences have moved to the foreground in recent years as videos of people opening e-commerce boxes and giving their impressions of the product and packaging sweep social media. Unboxing is "the first connection that a consumer would have with the brand or the contents of that package," Hanulec said. "And you should be able to support that experience with messaging, beautiful printing and really make a deeper and more responsive connection to the consumer" via digital inkjet printing.

Fortis' Daniels noted a customer example in which sandwiches at gas stations or convenience stores are made and distributed by large companies off-site but digitally printed with labels that bear the convenience store's logo. "It'll look like a localized, individual gas station has their own line of sandwiches," he said, explaining that feature is important because "you are seeing the trend of people wanting to buy local, buy small and not so much buying from the big guy."

On-box advertising is a "huge potential growth area" for digital printing, Hanulec said. "It's sort of a travesty to think about that undecorated, unfulfilled space on that beautiful box."

My wife got a package from Amazon today covered on all sides with marketing for Taylor Swift. Congrats to Jeff Bezos on monetizing a cardboard box, but I was disappointed the delivery guy wasn't wearing a Taylor Swift mask & costume. C'mon Jeff—that would generate serious buzz. pic.twitter.com/mIhFsuCpiO

— Ted Gioia (@tedgioia) August 27, 2019

Case in point: Amazon temporarily updated its standard brown cardboard boxes in 2019 with on-box ads for Taylor Swift's newly released "Lover" album. The e-commerce giant randomly chose orders to ship in the limited-edition boxes. But using the randomization technique to reach target demographics now would be considered less sophisticated, said Hanulec, who received one of the boxes: "I couldn't name three songs, so I think they got the demographic wrong for me."

Digital inkjet printing opens opportunities for decorating inside the box, too, whether to simply print instructions or to add decorative features. Brands and shippers also are testing in-box digital printing to boost e-commerce security as package thefts rise.

While there are "some things that you have to coordinate with the print press environment to marry up both the inside and the outside of the box," the effort pays off, Hanulec said. "There's software to help make that happen with just a little bit of coordination to the ink technology, the coding technology."

In addition, brands increasingly are adding digitally printed on-package coding and marking. Digital inkjet printing's crisp images and reliability ensure scanning devices can read printed codes. Analog methods are more likely to create blurry images, which may render codes unreadable, sources said.

Brands can incorporate augmented reality via codes that a consumer scans to interact with the packaging. O-I added such options to some wine bottles with digital printing, and "when consumers go over the artwork with their mobile phone, the artwork will actually start becoming alive and take consumers to an online experience," Leeman said.

These features, along with hip, vibrant graphics, are especially popular with younger generations that crave more data and customization, Leeman said. Thus, digital printing enables brands to reach untapped audiences.

Plus, brands want to track and trace their products through the supply chain and get more data to the consumer.

"There's an explosion of data ... There's more and more need to print in-line information, and the need is to have higher print quality," said Philippe Lesage, vice president and general manager of HP's specialty printing and technology solutions business. "There's a big shift from very basic codes that back in the day were imposed by governments to protect consumers" to codes now being a brand-driven approach for data exchange.

As traceability technologies advance and offer more granular data, consumers could learn the level of recycled material in a product or where the materials originate. Brands would receive information about how many consumers scan that code and how they're interacting with it, so "there's definitely two-way" information sharing activity, Lesage said.

"We're pretty bullish on how this technology is really going to grow with that evolution of getting more and more data," he said. "There's not really that many technologies that can do that."

Editor’s note: Read the final installment of our series on digital inkjet printing, which looks at what the future holds for the technology and its use.