Numerous packaging manufacturers recently added equipment to enhance their production capacity, and some expanded their geographical footprints. These are some of the announced investments in North American packaging facilities during the last month:

- Cosmo Films added a new slitter at its warehouse in the Chicago suburb of Carol Stream, Illinois, to expand its capabilities for producing flexible packaging. The 120-inch-wide machine is capable of handling 3,000 feet of material a minute, will increase speed of delivery, and will help meet growing demand, the company said in a news release.

- Eco King, a China-based manufacturer of fiber table ware, will open a production facility in North Carolina, its first in North America. It will invest $80.5 million in the existing, dormant industrial facility in Robbinsville, where it will produce biodegradable items such as bowls and plates from wood pulp and recycled cardboard. The company, also called Kingsun, intends to hire 300 people initially and aims to add a total of 515 jobs over time.

- Flair Packaging acquired a second plant in Calgary, Alberta. The 35,000-square-foot production and warehouse space will be the new location for the company’s flexible packaging converting equipment. Flair also installed a 10-color flexographic printing press and a solventless laminator to expand capabilities at its existing plant in Calgary.

- Hood Container will invest $118.9 million to modernize its paper mill in West Feliciana Parish, Louisiana, which will result in an 80,000-ton per year production capacity increase. The first phase will start in the third quarter of 2026, and other additions will take place in 2027 during the mill’s annual outage in May. Hood received state incentives for the project, including an $800,000 modernization tax credit to be paid out over five years.

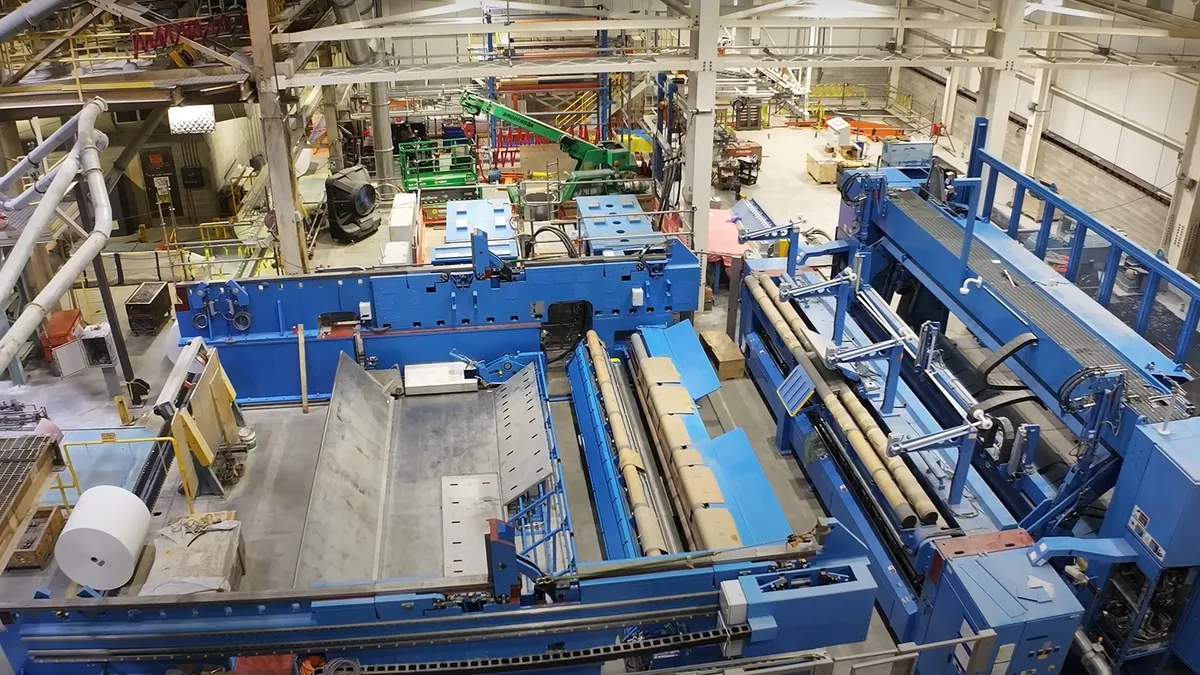

- Sappi completed the $500 million replacement of its No. 2 paper machine at its Somerset Mill in Skowhegan, Maine. The rebuild project will double the machine’s annual production capacity to 520,000 tons, with the full ramp up expected next year. This machine will produce solid bleached sulfate grades including for folding cartons, food service board and cups.

- Schütz Container Systems, an industrial container and packaging manufacturer whose parent company is in Germany, will expand its 14-location North American presence with a new facility in St. Joseph, Missouri. The $31 million investment involves building a new facility and adding a new manufacturing line for industrial packaging. The company expects to create 20 new jobs, and it’s receiving incentives from the state.

- TricorBraun signed a deal to lease a warehouse in Fairfield, California, reports the San Francisco Business Times. The Missouri-based packaging distributor is leasing the entire facility, which is more than 608,000 square feet, in a move to consolidate several smaller locations and increase efficiency. The building used to house glass wine bottle distributor Owens-Brockway Glass Container, which closed last year.

- Trioworld Group, a Sweden-based manufacturer of flexible plastic films for packaging, will open a production facility in Brownsville, Indiana, this autumn. This plant will double the company’s North American production capacity. The company initially plans to hire 33 new people.

- Uline, a Wisconsin-based packaging and industrial supplies distributor, plans to expand its East Coast presence with a new warehouse in Plainfield, Connecticut, according to the Hartford Courant. The company’s 15th fulfillment center will be 1.2 million square feet and is expected to add 250 jobs. The warehouse is anticipated to open in July 2026 and be fully operational by that November.

Other updates:

- Huhtamaki, headquartered in Finland, reached the 100-day mark in its integration with newly acquired Zellwin Farms in Zellwood, Florida. The $18 million transaction will grow Huhtamaki’s North American manufacturing presence in molded fiber egg carton and egg flats markets.

- Republic Services, a waste and recycling company, announced that it will open its third polymer center in Allentown, Pennsylvania, joining plastics recycling sites in Indiana and Las Vegas. The facility will work in partnership with a nearby Blue Polymers facility to process recycled PET, HDPE and polypropylene into new materials. Blue Polymers is a joint venture between Republic and plastic producer Ravago. Republic aims to create a nationwide network of polymer centers.