Even though the U.S. Food and Drug Administration hit pause on the Food Traceability Rule, that doesn't mean companies across the supply chain have stopped adopting tracking tools. Many industry participants and observers in the RFID for packaging space don't think the changed timeline will mute work on the technology.

Food companies and retailers had been pushing to embrace tracking technologies, such as radio-frequency identification, ahead of the deadline, and packaging suppliers have worked to incorporate RFID tags into their products. But some companies struggled with timely tech adoption in the lead-up to the FDA's compliance deadline of January 2026, prompting organizations including the Food Industry Association to applaud applaud the agency's March announcement of a two-and-a-half year compliance extension to July 20, 2028.

FDA proposed the rule during President Trump's first term, following multiple E.coli outbreaks tied to romaine lettuce. The intent was to boost producers' recordkeeping and traceability for foods at high risk of contamination so companies could easily identify involved suppliers during a foodborne illness outbreak. Companies must track key data across the supply chain and quickly submit records requested by FDA in instances of potential harm to the public.

The government mandate appeared to accelerate deployment. Although RFID has been around for decades, "I am seeing a — I'll use the word 'resurgence' — of RFID investments" in the last 12 to 18 months, said Sandeep Unni, a senior director analyst in Gartner's retail industry research practice. "This became sort of an emergency that they needed to quickly turn around and make that investment, pivot to ensure that they had the compliance come January of '26."

Implementation didn't accelerate enough, though, which prompted the agency's extension. While the extension might temper movement, it's unlikely to change the overall trajectory, sources say.

"It slows down this expected boost to the RFID industry, but I don't think it shuts it down," said Kirsten Newquist, CEO at Identiv, a digital security and Internet of Things technology company. "My understanding is the FDA is still committed to these regulations. They're just pushing it out to give everyone the time they need to be able to set up the systems accordingly."

Although implementation could decelerate in the near term, the sector ultimately is poised for growth, experts say. Tech and packaging companies continue to advance RFID design to overcome known challenges, such as functioning in various temperatures, and to ensure recyclability.

Other motivating factors

While RFID has had a place in transportation logistics for some time, it's still on the early end of adoption in food, observers say.

"This is technology that really allows companies to be able to be compliant with these regulations, and in a way that's way more efficient and cost effective, we believe, than traditional bar codes or QR codes," Newquist said.

During the last decade, certain retailers and food companies moved forward with RFID for packaging due to factors outside of the FDA. Walmart is considered a major force driving businesses to adopt the technology. Over two decades ago, it launched a mandate that some suppliers use RFID on certain products the retailer carries, which it has since expanded to cover nearly every product.

Grocery giants Albertsons and Kroger also have traceability programs in place. The former was an early adopter more than 20 years ago, and the latter announced in October that it would roll out Avery Dennison's RFID inventory automation technology across fresh foods departments.

Chipotle introduced RFID nationwide after a 200-restaurant pilot in the Chicago area and asked its suppliers to tag their products. It's the first restaurant chain to make use of this type of inventory management system, according to the company.

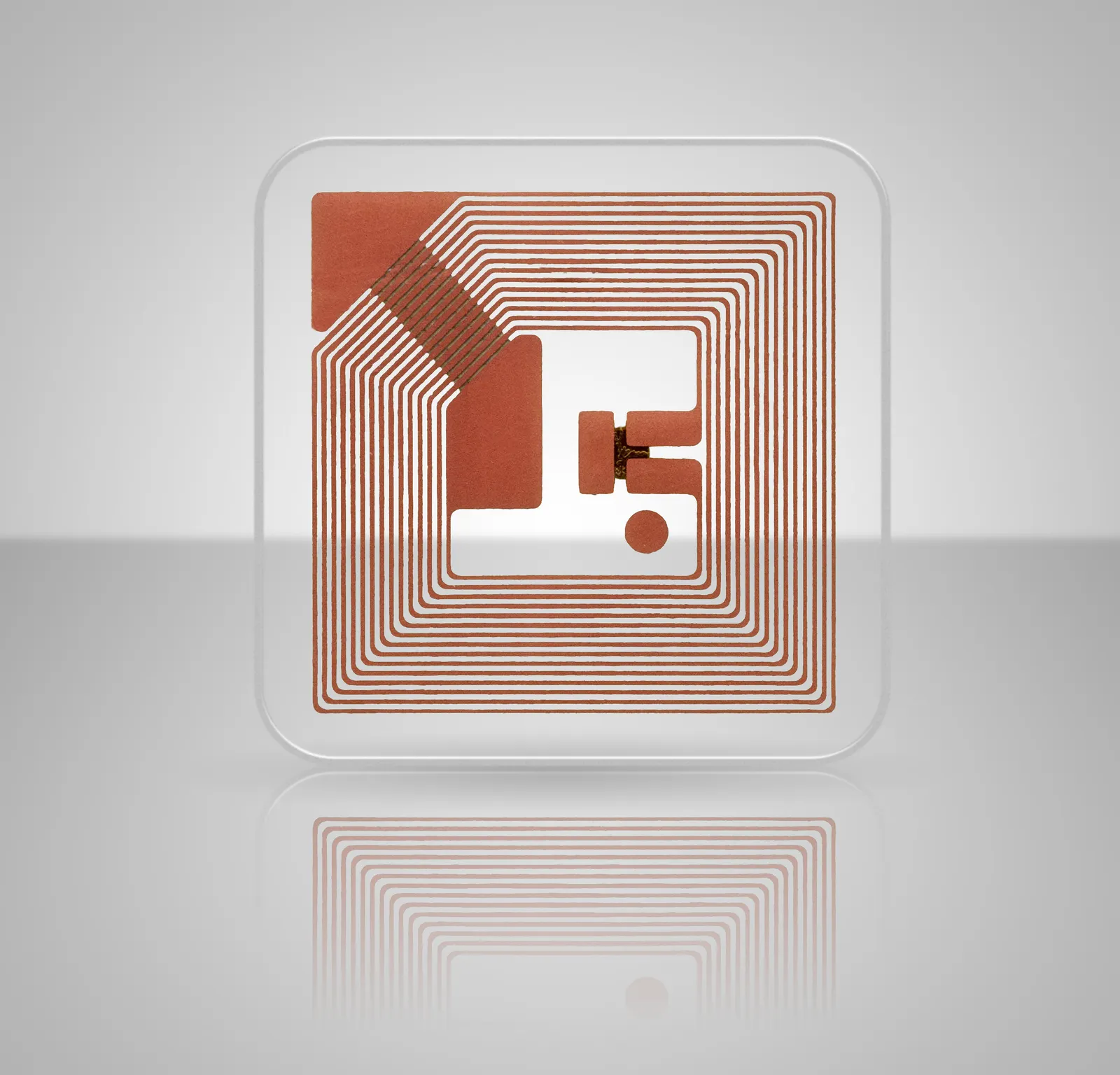

In the packaging and labels space, Avery Dennison often is heralded as an RFID leader. While early work involved incorporating smart labels on soft goods, such as clothing, the company has expanded its reach into other packaging markets, including food.

"We're adding the inlay into the actual packaging materials. And we use a lot of our material science roots to make that as seamless as possible," said Julie Vargas, vice president and general manager of identification solutions at Avery Dennison. "When you do have a food safety event, you know exactly what those serial numbers are and you can isolate those for a recall event."

Companies continue to identify new markets to introduce the technology. For instance, it's gaining popularity for inventory management of high-value products to prevent counterfeiting, such as for wine, watches and jewelry, Newquist said.

Before scaling RFID, Identiv customers are typically interested in pilot projects — an especially important step for new applications, Newquist said.

"They want to make sure that their assumptions around the return on investment are valid, but also just the practical implementation: tagging, read rates, kind of all the assumptions that go into planning and launching a new RFID system," she said.

RFID can improve efficiency by slashing the time needed for labor-intensive inventory tasks.

"When you're counting boxes, you don't have to actually scan 100 bar codes. You're taking a wireless scan of 100 things, and it's picking up 100 numbers," Vargas said. "Supply chains have never been more complex than they have in the past four to five years, so it's ... really valuable for businesses to optimize these types of scenarios."

Still, there’s room for additional improvement when it comes to incorporating the technology in packages. "Physics gets in the way of certain types of packaging," Gartner’s Unni said.

Radio frequency "doesn't play nicely with things like metals and liquids, so we've done a lot to innovate to overcome that," Vargas said. She described how specialty inlays or antennas that are inserted into the packaging itself, instead of in a surface label, alleviate some of those challenges.

Although radio-frequency technology hasn’t traditionally performed well in temperatures or humidity levels outside typical ambient range, that's changing, too. Modern systems now allow real-time location tracking and temperature monitoring in cold-chain settings, including for pharmaceuticals, Newquist said.

Concerns remain about heating metal smart tag components, such as in a microwave if a frozen meal has a tracker on the packaging, but design evolutions are making headway. Although technology improvements are solving some of these challenges, "the reality is that in those types of environments, broader adoption still lags," Unni said.

Recyclability check

For all of RFID’s potential benefits, there are also concerns about impacts to a package’s sustainability profile, namely whether and how the smart tags’ metal wires, plastics and other materials affect packaging recyclability. Research and testing generally points to RFID devices not impairing recyclability, sources say.

"Our mission is to make it the least intrusive as possible," Vargas said. "We've done a lot of work with different MRFs and recycling facilities to make sure that it does not impact the recyclability work stream."

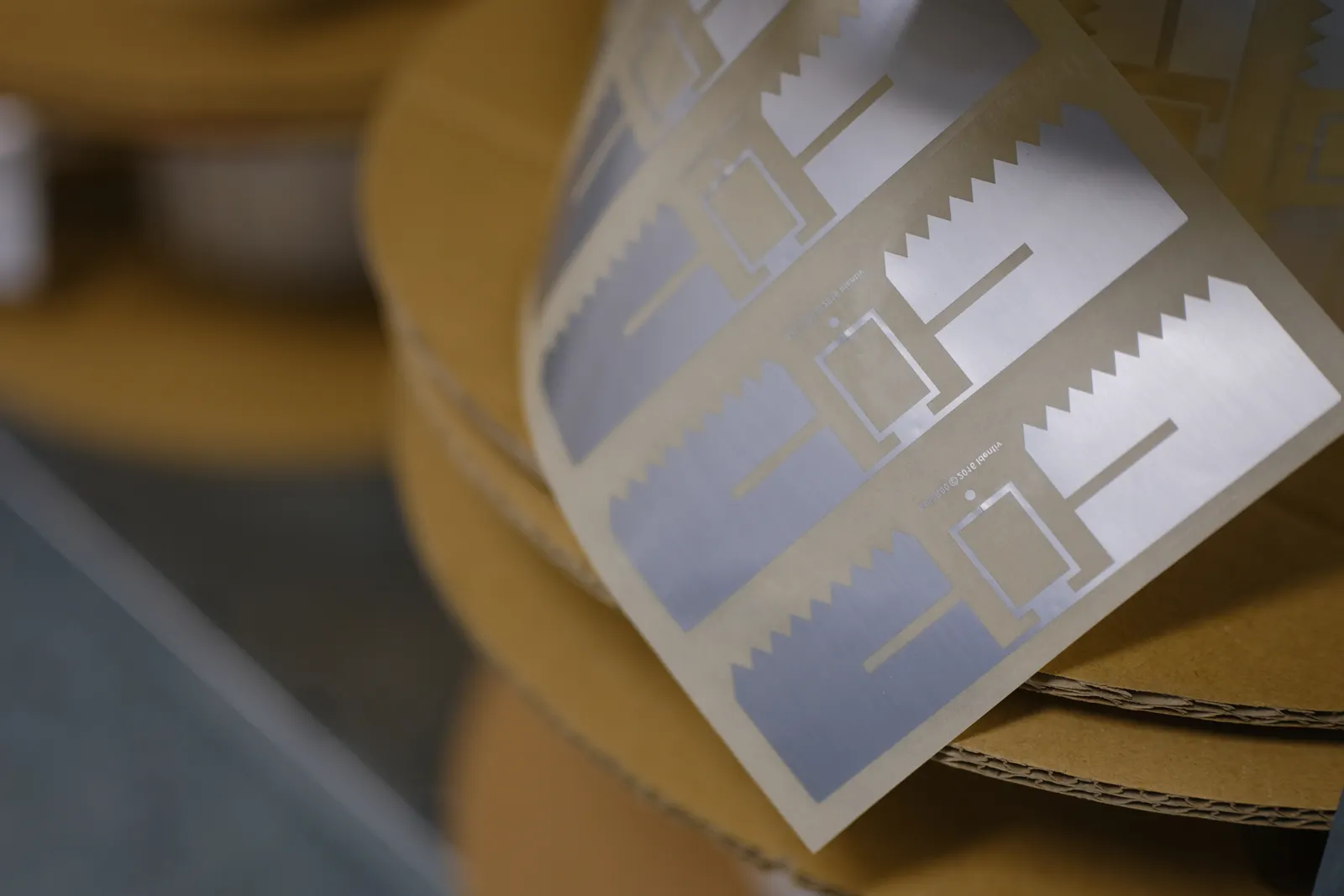

Last year, Smurfit Westrock released a report on the topic, based on a study conducted in partnership with Western Michigan University on corrugated boxes with smart tags, including RFID versions. The researchers examined what happened to tag materials during box repulping. Upon testing paper samples made from the repulped boxes, no residual metals were detected by a metal detector. The researchers concluded that smart tags do not have a notable impact on corrugated box recyclability.

"All of the materials were removed during the grinding process," said John Dwyer, director of business development at Smurfit Westrock, during a 2024 interview. "We're able to easily separate the corrugate material from the waste product, so there was zero negative impact on fiber recovery."

Although smart tags can be separated from recyclable packaging materials, the tracking components are not recycled, Dwyer said. That material is disposed as waste, similar to tapes or staples that are separated from corrugated boxes during recycling. "It's such a small amount of material; it's negligible," he said, pointing out that the silicon chips inside the tags are smaller than a grain of sand.

Smurfit Westrock already observes a considerable amount of smart tags traveling through its recycling facilities and expects that volume to balloon. At just one mill, the company recently saw more than 1 million RFID labels over the course of just a few months, Dwyer said. "So we know that this is happening. We know that it's growing."

The company believed it was important to conduct new research on RFID and box recyclability because the last notable study on the topic occurred nearly 20 years earlier, prior to many technological advancements that could impact modern recycling practices. Smurfit Westrock wanted to draw conclusions before the technology reaches critical mass and it would be too onerous to reverse course.

"We didn't want to tell people on the front end that it's good to put tags on packaging and not be a source of truth," Dwyer said. "So on the back end, we did the work. And now we can, with confidence, recommend that you can use them."

Anticipating expansion

Even if RFID implementation experiences a temporary slowdown stemming from the FDA’s extended compliance deadline, sources predict significant growth for the next few years.

Avery Dennison reported a 15% compound annual growth rate for sales of its intelligent labels between 2018 and 2024, and it’s targeting that same percentage for long-term organic sales growth going forward. The company sees considerable opportunities to grow in markets such as food, according to a newly released investor presentation.

RFID early adopters "are providing a leadership space that will actually create a real flywheel around this," Avery Dennison's Vargas said of the traceability trend. But other wireless tracking technologies, such as bluetooth low energy and near-field communication, are entering the space and putting pressure on RFID's market foothold.

Even so, RFID use in packaging won't wane anytime soon, sources say. "RFID is still very much relevant," said Gartner's Unni, noting that he is "cautiously bullish" on its future. "Those that have leaned in on RFID earlier ... I think this is the natural extension to scale this tech into their supply chain and realize the additional benefits, as well as compliance."

Observers believe that RFID not only will maintain its role in packaging and product traceability, but in fact will expand — both organically and driven by regulation.

Phenix Label announced in January that it had doubled its production capacity for RFID-enabled packaging for hard-to-tag retail items, including some liquids. Describing a newly announced deal between RFID tech solutions provider Radar and retailer Old Navy, Michael Roxland, Truist Securities senior paper and packaging analyst, said in a March note to investors that the project signals retailers' "continued interest in the technology."

Economic uncertainty resulting from tariffs could dampen traceability investments, but the impact likely will be short-lived, sources say. For instance, most of Avery Dennison’s cross-border trade in North America, including for RFID technologies, is compliant with the United States-Mexico-Canada Agreement, Roxland noted in April.

RFID for packaging isn't only about ensuring food safety and quality. But food traceability very well could be what pushes the technology toward mainstream adoption in the coming years.

"This is going to be the rails that the industry runs on. And we're just getting started," Vargas said.