South Africa-based Sappi Ltd. and Finland-based UPM-Kymmene Corp. announced their intention to combine forces in their European business units to form a joint venture for graphic paper worth an estimated 1.42 billion euros, $1.65 billion. The deal includes a mill in the United States and has broader implications for the North American market.

The companies say they already have signed a non-binding agreement, plan to sign definitive agreements in the first half of 2026 and expect the deal to close by the end of next year, pending regulatory and shareholder approval. The independent JV would not be listed on a stock exchange.

The proposed venture is intended to boost profitability while the European graphic paper industry experiences a “sustained structural decline in demand” in addition to overcapacity and low utilization rates, according to a Sappi news release. Other conditions contributing to market deterioration include rising input costs as well as trade and tariff stress. Wood and energy costs, in particular, have gone up since Russia’s war in Ukraine began, said Sappi CEO Steve Binnie on a Dec. 4 investor call about the transaction.

The two companies’ leaders say the JV would provide a way to boost resilience while offering customers long-term supply security.

“We've looked at many options over the years, and we believe that consolidation, rationalization of the industry, makes a lot of sense and it creates better balance,” Binnie said during the call. “The business that we're going to be creating will be more stable, more resilient and adaptable to the dynamics in the environment.”

“The new UPM will have, or will see, improved profitability, a stronger balance sheet, a lower leverage and a much stronger growth-oriented portfolio,” said Massimo Reynaudo, president and CEO of UPM, during a separate Dec. 4 investor webcast about the transaction. “The joint venture will have products basically serving all the needs of the graphic paper industry. ... From a geographical standpoint, it will be a global business,” although the focal point is in Europe.

Operational synergies upon completion of the deal are expected to total at least 100 million euros ($116.5 million) annually, while achieving greater profitability and stronger cash-flow generation compared to what the companies could achieve on their own. Sappi’s business is valued at 320 million euros ($372.7 million) and UPM’s is valued at 1.1 billion euros ($1.28 billion).

Three years after the deal closes, either company will have the option to divest their share of the JV, said UPM CFO Tapio Korpeinen, during the company’s investor call.

Both Sappi and UPM also have numerous locations in the United States that are not directly part of the proposed JV.

Proposed structure

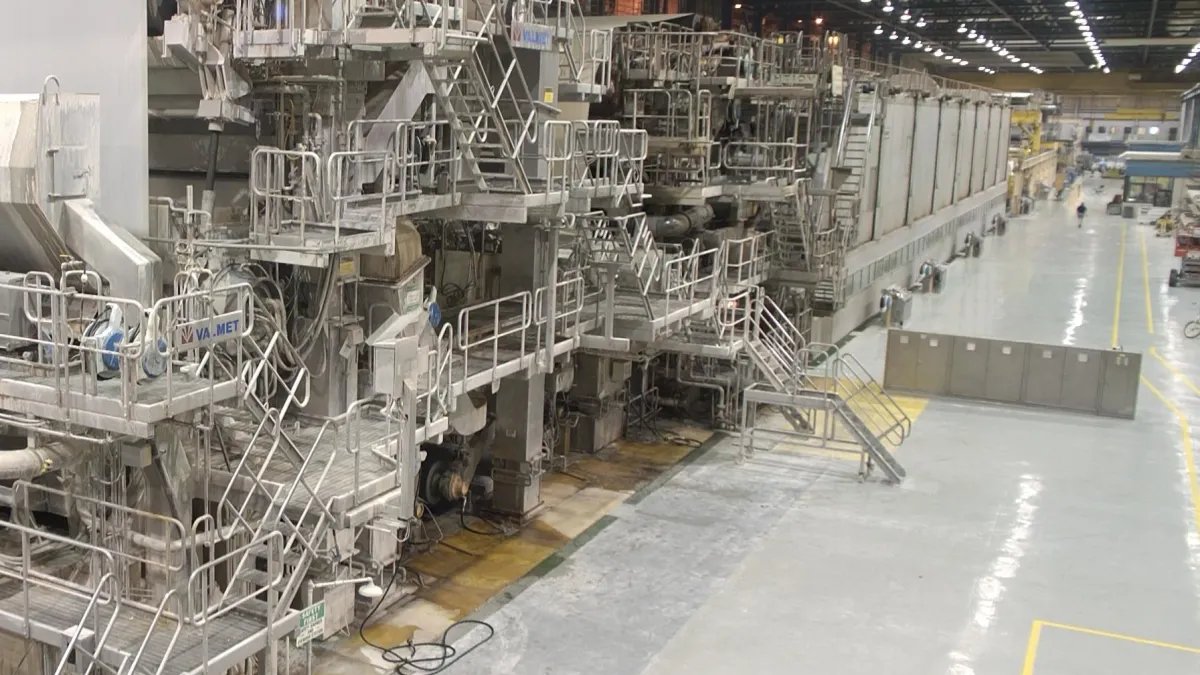

Sappi and UPM would both have a 50% stake in the JV, which would operate separately as an independent company. The companies say the new business’ structure would reallocate production volumes toward the most efficient paper machines, which would increase performance and utilization rates.

Under the deal, Sappi would contribute four mills and UPM would contribute eight:

- Sappi: Gratkorn Mill in Austria; Ehingen Mill in Germany; Maastricht Mill in the Netherlands; Kirkniemi Mill in Finland; plus European wood supply joint ventures.

- UPM communication papers assets at the following mills: Augsburg, Schongau, and Nordland paper lines 1 and 4 in Germany; Kymi, Rauma and Jämsänkoski paper line 6 in Finland; Caledonian in the United Kingdom; and Blandin in Grand Rapids, Minnesota.

These included sites make up less than 10% of UPM’s total assets, Korpeinen said on UPM’s call. After the transaction, about 20% of Sappi’s volumes will be in graphic paper, Binnie said.

Executives for both companies noted the deal will also enhance their sustainability efforts.

Industry impact

The European graphic paper industry has been under pressure for about 20 years due to factors such as digitization and the decline in printed newspapers. Beyond just the Minnesota mill moving to the JV, the proposed changes under this deal also could impact the broader U.S. fiber market and other U.S.-based companies.

“The North American graphic paper business remains integral to our strategy. That market is in balance,” Binnie said on Sappi’s call.

According to a Dec. 5 note to investors from Michael Roxland, senior paper and packaging analyst at Truist Securities, the JV could be positive for Packaging Corporation of America and Sylvamo, which are the third- and second-largest North American producers of uncoated freesheet, respectively; Sylvamo would become the third-largest producer in Europe if the UPM-Sappi deal goes through.

The European uncoated freesheet market exports approximately 500,000 mt to North America annually, Roxland said. Exports to the U.S. could decline if the JV partners rationalize their assets, he noted.

Still, U.S. uncoated freesheet producers could “benefit from potential closures of coated paper capacity as European coated paper producers have the ability to grade switch to uncoated paper by lifting their coaters,” according to Roxland.

“The work we are doing now will ensure that we are going to be capturing our fair share, or more than our fair share, of the growth that will come when the economic cycle will turn,” Reynaudo said during the investor presentation.