Digital printing for packaging has been slowly gaining steam the last few years and picking away at market share for analog systems such as flexography, rotogravure and offset lithography. But 2026 could be notable for the sector's maturation, according to a newly released report from consulting firm Keypoint Intelligence.

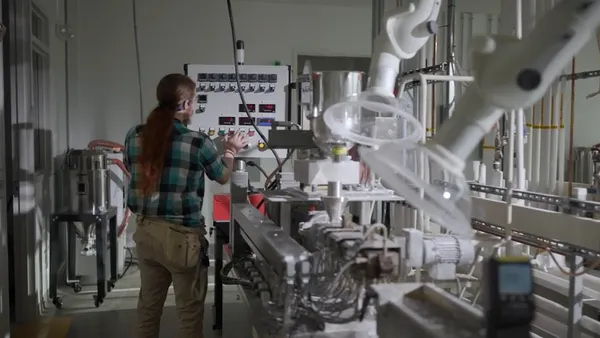

Digital printing is "entering a more mature, disciplined phase of adoption," the report says, and growth this year is expected to come from different avenues than in the past. The report notes that packaging converters are considering these solutions "less as standalone innovations and more as components within broader production and manufacturing environments."

While other industries are ahead with digital adoption, "it has been a little bit slower on the packaging side because of all of the aspects and the complexity with packaging. You're kind of over that curve now," said Marc Mascara, principal analyst for labels and packaging at Keypoint Intelligence. "All of a sudden, with the speed of AI and the way the brands are moving, and the way the economy is changing and moving ... [converters are] thinking, 'OK, how do I do digital faster and better?'"

The report presented several key themes predicting where digital printing for packaging is headed in 2026.

From specialty to mainline

Converters have realized the benefits of digital printing in their specialty applications and are beginning to adopt the technology for mainline production, according to the report. That’s projected to accelerate in 2026.

"They already understand specialty printing — that high value, high graphics type — because that's where they're doing all the corrugated work, the labels and the embellishments," said Mascara. "Now what they're looking towards is ... where can I build those efficiencies into my mainline?"

Versioning is one specialty application where the speed and efficiency of digital printing can translate well to mainline operations, he said. "That's where the converters are really looking for that ability to answer the call of the designs and everything that's coming from the brand side of the business."

Brands enter the equation

The adoption of digital printing for packaging so far has mostly been driven by converter experimentation, not from customers specifically requesting the technology. But brands will play an increasing role in determining where adoption accelerates, according to the report. This "visible shift toward brand-driven influence" is expected to be particularly prominent in the corrugated packaging and label sectors.

AI helps brands speed R&D for new products and marketing campaign development, and digital printing lets converters better keep up with customer demands compared with analog options.

"Having digital in place helps [converters’] turnaround time, and how they're more nimble and flexible to change with the things that brands want," Mascara said. "Brands will understand that something might be a little more expensive, but if they can switch this packaging in a matter of a month and get the product out faster, then they're going to go the way of digital."

Brands are also focusing more on sustianability, and digital printing is widely viewed as more sustainable than analog. That's partly due to the elimination of printing plates, which lowers waste and emissions.

AI adoption advances

Although brands will adopt AI much faster than converters, Mascara explained, the technologies will also aid digital printing for packaging.

"Brands are going to be using big data. They own the data. They know where things are going. They know the consumer," Mascara said. "AI is going to be able to help them predict how they're going to do their campaigns, how their product is going to go to market, who it is going to be targeted to, and AI is going to really help in the design aspect."

For converters, "AI is really going to be tied into the production side: all the information and data that's coming [and] how your production is going through the converting process," he said.

Software connectivity’s role

Converters won't start using AI regularly until all their digital printing systems are established and connected to the broader production systems, Mascara explained. "As soon as they get that out of the way, then they can start using AI for predicting how they're going to be doing their scheduling, and doing it faster."

When a piece of digital printing equipment is added to an existing production system, "it's got to connect to pre-press, it's got to be easy for the operators to run," he said. "Then that's where AI comes into play, with that operational efficiency."

"Digital is a big play, and it's really becoming the center of production," whereas previously it was "kind of on the fringe," Mascara said.

OEMs influence cohesion

With the focus on system connectivity and mainline production, OEMs need to evolve their product offerings for smoother integration and alignment with real-world manufacturing environments, according to the report. "All of this change is not going to happen if the OEMs are not active as well," Mascara said.

As equipment purchasers become more sensitive to integration risks and system cohesion, OEMs that focus on interoperability and data flow are viewed as better positioned to support customers, the report says.

In 2026, OEMs are expected to gain an even better understanding that "it's the whole workflow system they have to deal with, and they can't just drop off a piece of equipment and expect it to work," Mascara said. "There's a shift that we're predicting, coming from the OEMs, of how they're putting AI into their equipment."