Greif experienced a lot of internal changes during its fiscal fourth quarter, amid ongoing challenges with economic conditions and soft demand, executives said on the company’s Thursday earnings call. But Greif is ahead of schedule on executing its cost optimization plan that launched in fiscal year 2025, and it expects financial improvements in 2026.

Greif changed its fiscal year to end on Sept. 30, prompting the company to report two months of results for the fourth quarter and 11 months of results for full fiscal year 2025. That had an impact on comparables and results.

Taking into account the shortened fiscal year, Greif’s sale of its containerboard business to Packaging Corporation of America for $1.8 billion, and the company’s optimization program to cut $100 million in costs over three years, “we know there's a significant amount of change and noise for this quarter,” said CEO Ole Rosgaard. The company also completed the sale of its timberlands to Molpus Woodlands Group for $462 million as of Oct. 2.

Greif used the $2.3 billion in gross proceeds from the timberlands and containerboard sales to reduce debt, and its leverage ratio is now under 1x, Rosgaard said.

“We closed fiscal ‘25 as a more focused, more agile and more strategically aligned company than at any time in our history. Our transformation is accelerating, and the results are beginning to show,” he added.

Optimization efforts

In FY 2025, the company achieved $50 million in run-rate savings from its cost optimization program, which is more than double the previously stated annual target of $15 million to $25 million. As such, the company is accelerating its fiscal 2026 cumulative cost-saving run-rate commitments to $80 million to $90 million, up from the projected $50 million to $60 million. The new savings total, to be achieved in fiscal 2027, is $100 million to $120 million.

“Our current optimization program has continued to evolve since the start of the year. What began as a top-down initiative is now being fueled from the ground-up,” Rosgaard said, describing how employees are driving local action and identifying new opportunities.

As part of the streamlining, Greif eliminated approximately 8% of professional roles in Q4, Rosgaard said. The company also revisited its stable of contractors, such as for IT functions, and restructured its pay model for AI activities, said CFO Larry Hilsheimer.

“We're removing unnecessary layers to empower local leaders and speed up decision making, and we are embedding a mindset of efficiency, responsiveness and value creation,” Rosgaard said. “It's a structural shift in how we operate, compete and grow.”

Segment results

Greif reported net sales of more than $701 million in fiscal Q4 and full-year net sales of $3.93 billion.

Demand softness in industrial markets impacted Greif’s Customized Polymer Solutions segment during fiscal Q4, resulting in flat sales volumes year over year. However, small containers had positive momentum. The company has been investing in this space to grow both organically and via M&A, Rosgaard said, and overall the polymers business is growing.

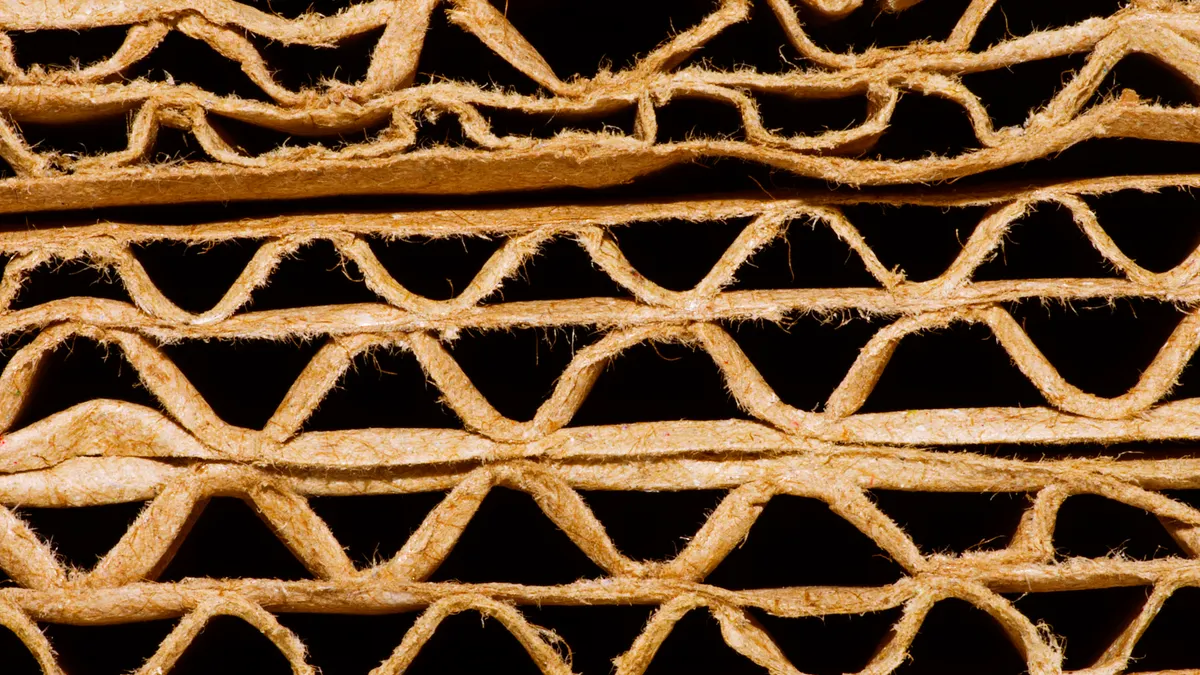

Sales volumes for Sustainable Fiber Solutions dropped 7.7%, reflecting economic downtime in September at an uncoated recycled board mill and ongoing soft demand for fiber. Even so, gross profit dollars and margin improved year over year, Hilsheimer said.

Sales volumes for Durable Metals declined due to softness in industrial end markets, Hilsheimer said. “But we continue to generate healthy cash flow and remain focused on cost reduction and enhancing agility to react as demand recovers.”

Integrated Solutions continues to see volume improvement, Rosgaard said. That’s driven by closures, which generated more than a 30% growth margin.

Synergies in operating the adhesives and recycled fiber businesses as part of the Sustainable Fiber Solutions segments became evident during execution of the cost optimization program and containerboard divestiture, Rosgaard said. Therefore, those products will be reported within the fiber segment’s results as of fiscal 2026.

The Integrated Solutions segment will primarily consist of closures, prompting the company to rename it to Innovative Closure Solutions. It represents a “highly profitable and critical growth focus” business, Rosgaard said.

Outlook

Given the prolonged industry downcycle, executives provided low-end guidance for FY 2026 of $630 million in earnings before interest, taxes, depreciation and amortization, reflecting overall flat volumes. Adjusted free cash flow is projected to be $315 million.

The company anticipates flat to low single-digit volume declines for metals and fiber, but low single-digit volume increases for polymers and closures.

“We have acknowledged that the last 11 months have been bumpy, given all the change occurring,” Rosgaard said. “We are proud of how we finished fiscal 2025 more focused, more efficient and more aligned with our long-term strategy. We’re also excited for a cleaner outlook in full year ‘26.”