Over the last year, International Paper has conspicuously undergone a business overhaul under the guidance of CEO Andy Silvernail, who launched the streamlining initiative shortly after taking the top role in May 2024. Silvernail dug into what’s behind the changes, and the differences between the United States and European markets, during a Sept. 4 session at the Jefferies Industrials Conference.

IP launched the 80/20 optimization plan in 2024, prompting series of changes. “It's actually kind of breathtaking when you look at the number of actions that we have taken and the impact that we've had,” Silvernail said.

A year of U.S. changes

As a recent example of the numerous adjustments, Silvernail cited the three announcements that IP simultaneously made on Aug. 21: the sale of its global cellulose fibers business to private equity firm American Industrial Partners for $1.5 billion; the closure of four sites in Georgia, including two mills, that will affect 1,100 hourly and salaried employees; and investing $250 million to convert the No. 16 machine at the Riverdale mill in Selma, Alabama, to produce containerboard instead of uncoated freesheet.

The Savannah and Riceboro containerboard mills in Georgia are “aged or strategically inferior assets. And in our business, strategically inferior assets are simply a problem” with “terrible returns on capital,” he said. Keeping Savannah open would have required major repairs with a cost of roughly $300 million, and still that wouldn’t have produced the desired returns down the line, Silvernail said. Instead, the $250 million investment in Riverdale is not only cheaper on the front end but also will have notably better returns, he explained.

Attention to underperforming assets is particularly important in difficult economic cycles, he said. In the past, a reason for not shutting down inferior assets during down cycles was that the capacity might be needed when the market comes back. But in reality, when a market comes back and “you actually map it over the cycle, it doesn't ever make money with those crappy assets,” he said. “We would rather run tight than run loose through a cycle.”

Further, eliminating less desirable assets frees up resources that can be invested into services. “That’s why you’ve seen a huge spike in our service levels in the U.S.” under the optimization plan, he said. Improved service and customer satisfaction ultimately enable winning greater share in attractive markets.

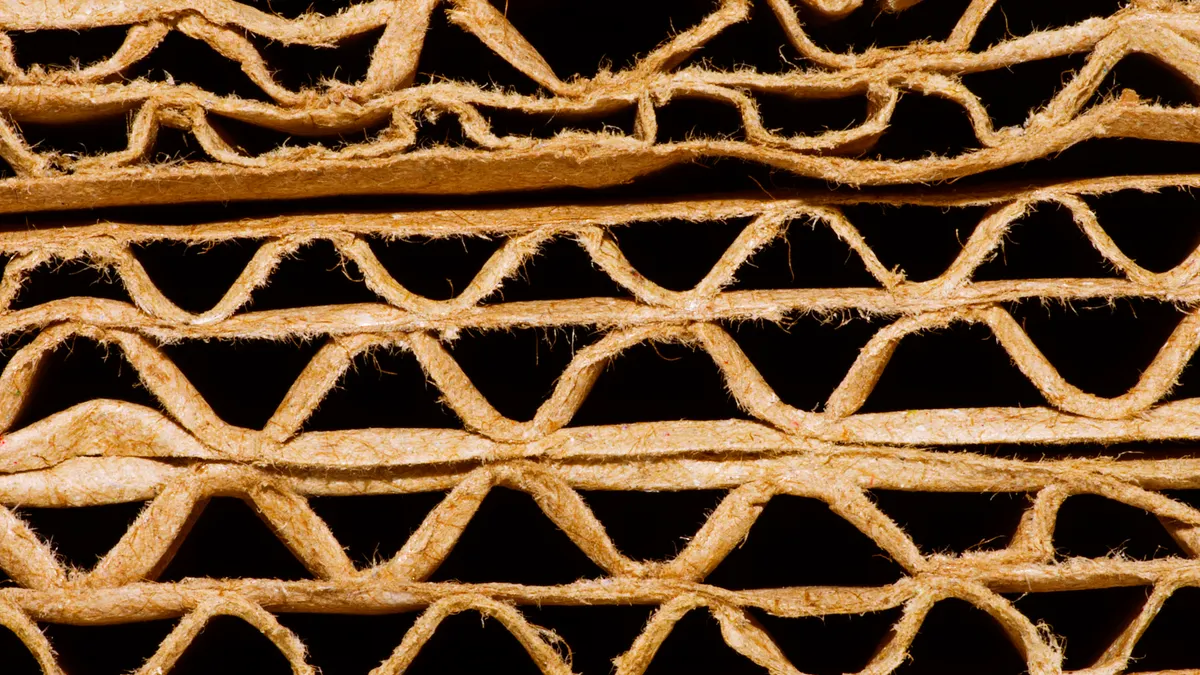

The strategy shifts reinforce that “No. 1, we are a packaging company, and only a packaging company,” Silvernail said.

Historically, IP was a broad-based fiber company with up to nine business units and a large, centralized structure, he explained. “We blew up the centralized structure last year. We radically decentralized back to be closer to the customers, closer into the field. And we're focusing on packaging. If it doesn’t lead to packaging, we really don’t have much interest.”

Being a pure-play packaging company is a less volatile business model, he said. “If you look at the marketplace, and you take the paper-based businesses, and you actually look at returns on capital, those that are packaging-centric versus everything else — it's not even close.”

Looking at U.S. market conditions in general, Silvernail predicts improvement will come soon. Current demand appears “much closer to a bottom or more difficult moment now than I can imagine in the future,” he said, adding that it’s hard to believe things wouldn't be different in two to five years.

Launching changes in Europe

This year, IP started its 80/20 transformation in Europe, following the January acquisition of London-based DS Smith. The goal is to remove $500 million to $600 million of costs in that region. The European restructuring game plan is roughly 80% similar to the U.S. plan, but there are some differences, Silvernail said.

The levels of integration are one example, he said, noting that the U.S. is nearly entirely integrated while Europe is only 50% integrated. The goal is to become more integrated in Europe, but that will be done through optimizing existing assets there rather than buying new ones, he said.

Cost cutting via facility closures takes longer in Europe due to requirements for a “consultation process” to explore alternatives, rather than the U.S. model of simply executing announced actions, he said.

On the positive side, the legacy DS Smith business in Europe had been more customer service-focused than IP had been in the U.S., so less work needs to be done there, Silvernail explained. Europe is also a more innovative market, he said.