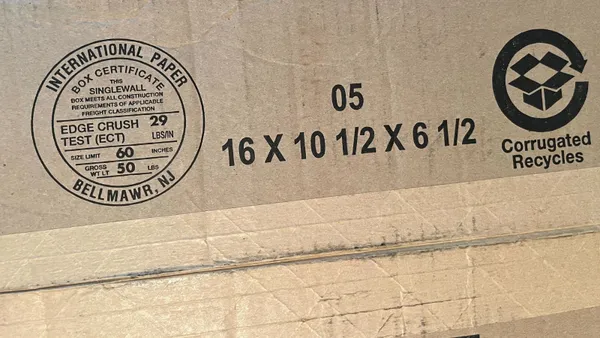

- Overview: “The North American team is facing headwinds that we didn't expect, but we're being aggressive with the realities of that. We're getting after it,” said International Paper CEO Andy Silvernail during the company’s third-quarter earnings call Thursday. “In Europe, it's been a tough market, no doubt about it.” Specifically, “the soft market has cost more than $500 million in profit this year alone,” he said. September box shipments were up 1% year over year, and that trend continued into October, said CFO Lance Loeffler.

- Transformation plan: Executives are “delighted to see the progress in North America” on the company’s 80/20 business transformation plan that launched stateside last year, Silvernail said, adding that the “strategy is getting traction.” It’s now being implemented in Europe following IP’s acquisition of London-based DS Smith in January, including “lighthouse pilots” in the U.K. and Spain. However, “market softness and negative price movements have made the start to the DS Smith acquisition challenging,” Loeffler said. “Obviously, [Europe, the Middle East and Africa] is not in the position we expected this year.”

- Divestitures and staff changes: IP announced in August that it would sell its global cellulose fibers business to private equity firm American Industrial Partners for $1.5 billion, and it still expects to close that deal by year’s end. This month IP also sold its bag converting operations to ProAmpac. Most benefits of those deals will be realized in 2026, executives explained. Last week, IP also announced it will lay off in-house IT workers and instead contract with Infosys for IT needs.

- Closures: In August, International Paper announced four closures, including its Georgia containerboard mills in Riceboro and Savannah. “Both of these mills had significant near-term capital requirements and did not return their cost of capital through the cycle,” Loeffler said. Silvernail said Riceboro was “never going to have the cost position to compete, so it made sense to move that volume to other mills.” IP also intends to “move aggressively toward rightsizing Europe. We have to,” Silvernail said, reiterating that takes more time due to European requirements for a “consultation process” to explore alternatives to closures.

- Investments: Concurrently with the closure announcements in August, IP mentioned a plan to invest $250 million to convert the No. 16 machine at its Riverdale mill in Selma, Alabama, to produce containerboard instead of uncoated freesheet. Operations there should begin late next year, executives said. Following the decision to close Savannah, the company redeployed approximately 30 people to Riverdale and moved $300 million in capital to the Riverdale conversion, Silvernail said. He expects 20% returns on the Riverdale investment. Moving capital from Savannah to Riverdale is “a really, really important trade,” Silvernail said. The company could capture roughly $400 million that’s “waste in the system” by investing aggressively in the mill system, Silvernail said.

- Sylvamo agreement: Paper company Sylvamo spun off from International Paper in 2021, and at that time it entered an agreement to purchase certain products from IP’s Riverdale mill. While executives on IP’s Oct. 30 earnings call did not address it, the two companies entered a new agreement this week, according to an Oct. 27 securities filing. IP will continue to supply Sylvamo until April 30, 2026, and will wind down in May, with the agreement set to end May 30. The agreement also contains pricing clauses.

- Outlook: IP lowered its guidance for full-year earnings before interest, taxes, depreciation and amortization due to ongoing weakness in North America and EMEA. The 2025 EBITDA projection is $3 billion, down from the April expectation of between $3.5 billion and $4 billion, which was unchanged during July earnings. Executives anticipate relatively stable demand in Q4. Full-year box shipments are projected to be down 1% to 1.5% for 2025 instead of up by the same range as anticipated at the beginning of this year. Executives expect market softness and economic headwinds to continue into 2026.

International Paper reverses 2025 box shipment expectations

Although box shipments ticked up in September and early October, full-year volumes are now expected to be down, executives said on Thursday’s earnings call.

Recommended Reading

- International Paper CEO describes wins, challenges with transformation plan By Katie Pyzyk • Sept. 10, 2025

- International Paper sets sights on mill improvements By Katie Pyzyk • Aug. 1, 2025