With its public Material Transitioning Dashboard, PMMI is offering a window into how companies are changing the packaging materials they use.

PMMI (the Association for Packaging and Processing Technologies) puts on multiple Pack Expo events each year, like the most recent show in Las Vegas from Sept. 29 to Oct. 1. This year, the event’s more than 30,000 registrants had the opportunity to respond to questions about their packaging materials. Specifically, they were asked to select up to three materials their company would replace in the next five years, if any.

“If you ask me, they are the most qualified people to tell you what materials will be changed,” said Jorge Izquierdo, vice president of market development at PMMI, during a presentation at Pack Expo.

PMMI says it has been collecting materials usage data from end users since 2022. Its current dashboard tool presents data from 2024 and 2025. PMMI has about 48,000 respondents and close to 147,000 individual data points, according to Rebecca Marquez, PMMI’s director of custom research.

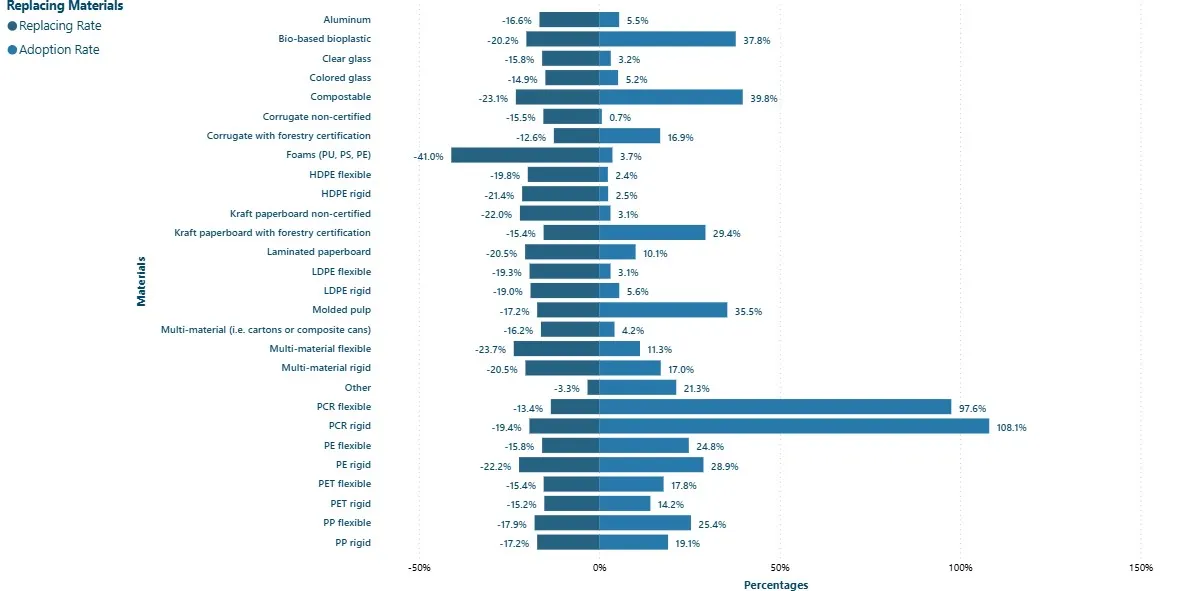

When sorting for data from Pack Expo Las Vegas 2025, there are 14,000 data points. That data can be further narrowed by industry or product type to reveal sector-specific material change insights, including in personal care, food and beverage or healthcare.

According to all of the U.S. data currently available, the top responses for materials to be replaced in the next three to five years were polystyrene, foams (including PS) and polyvinyl chloride. As for the materials most likely to be adopted in that same time frame, recycled options topped the list. The most popular responses were rigid and flexible PCR, as well as recycled paperboard with a forestry certification.

PMMI plans to expand data collection in the years to come. There are both U.S. and Mexico versions of the dashboard.

“Our goal is to leverage our industry access to provide a free, strategic tool back to the packaging industry,” Marquez said in emailed comments. “Perhaps one day, it would even be used to inform materials legislation.”

Marquez said the tool stands to benefit OEMs and their customers in many different ways. The data can help better project trajectories of change, and that awareness can help OEMs and CPGs jointly plan more proactively and better prioritize R&D and innovation.

For example, when OEMs understand which materials are on the rise, this can guide machinery design so that new systems align with substrates customers will be using several years down the road, she explained.

Shifting substrate trends also change economies of scale. “Early insight allows companies to capture cost advantages or re-engineer packaging lines to avoid inefficiencies tied to obsolete or specialty materials,” Marquez said.