Combining two packaging giants headquartered across an ocean results in a lot of learning for leadership. That’s the case for Laurent Sellier, CEO of Smurfit Westrock North America, following Ireland-based Smurfit Kappa’s acquisition of Atlanta-based Westrock in July 2024.

After more than 30 years with Smurfit Kappa in various roles in Europe, Sellier arrived in the United States in October 2021 to serve as its CEO of the Americas division. He was mostly in charge of the company’s legacy Latin American business at that time, because it didn’t have much of a presence in North America — just a few operations in the southern U.S. The combined company now has roughly 305 locations in North America.

“I'm only now getting to familiarize myself, really, with the North American market” in the new role at the combined company, Sellier said.

This year, he embarked on a packed schedule of touring Smurfit Westrock’s North American assets.

“The best way to energize, dynamize and identify the right strategic opportunities is always to go to the operations,” he said.

Sellier spoke with Packaging Dive about how the combination is going, differences between the U.S. and European markets, and his passion for hands-on management.

This interview has been edited for length and clarity.

PACKAGING DIVE: What are your top priorities in the North American market right now, and have they shifted since the company combination last year?

LAURENT SELLIER: The priorities have not fundamentally changed since we joined forces. I think there was a fundamental belief that the coming together of the two companies would really help on a number of fronts.

The first of them probably would be on the final market side, so on the corrugated side and on the consumer side, which are two main outputs in the U.S. in particular. Making sure that we bring innovation to the front in a very loud manner. And that is only possible when we've put the house in order with very basic elements, like on-time in-full or quality. So one of the key first principles was to put the house in order.

The second one was organization. The two companies are similar in many respects, but they were also very different — and the main difference was organization. WestRock was going very much into a centralization direction, with lots of responsibilities taking away from the operations — whether it's HR, finance, legal, commercial, you name it. And even production, in some cases, had people in the plants that became an administrator of the assets, if you will. The Smurfit Kappa angle was always to try and make sure that every single box plant and every single paper mill operates almost as a standalone company.

Always in mind is the collective better, the greater good. Always in a very collaborative manner, but also having people on top of their own destinies. That's what we're doing right now.

We call it the owner-operator model and acknowledge that there are spaces like purchasing, for instance, where obviously being big and strong and central is a value. But for the vast majority of the functions, being decentralized and closer to the operations is more likely, in our view at least, to be effective for the longer term.

You’ve been in Americas markets for roughly three years, but most of your time with the company has been in the European market. What similarities and differences have you observed in these spaces?

The most evident type of differences is twofold. One is the relationship between employer and employee — that's a space that has been always very important back in Europe — to create a reciprocal type of loyalty.

I think the history of employment in the U.S. has been rough, oftentimes, from the employers and from the employees both having a lot of choices and exercising those choices. Probably there's a balance to be found between the two options. Certainly we're doing a lot of work to reduce the attrition and turnover of people here in the U.S., and trying to build a more core group of people who are enjoying the company and willing to invest in the company for the longer run.

The second big difference is the asset base the European landscape, because it's an agglomeration of individual countries as opposed to the U.S. For a long period of time in Europe, there's been a lot of fragmentation, and there's a lot of pure players — pure corrugated players, pure consumer players, pure paper players — and that has created a dynamic with heavily invested companies, in general terms, oftentimes family owned. The state of investment of the European assets is very good in general terms.

To the contrary, in the U.S. I think there's been a lot of mergers and acquisitions, so a lot of money has been invested in those capital structures more so than in the equipment. I think there is a great opportunity, just because a lot of assets can really benefit from the expertise and the cross-fertilization between the two continents.

Extended producer responsibility for packaging is more established in Europe, but it’s just beginning in the U.S. Are you seeing EPR affecting your North American sales or requests for new products?

We have a product that, in essence, is very recyclable, it's renewable, it's biodegradable. So it's not a bad place to be when you deal with EPR. The European experience is that EPR creates obligations and complexities, but by and large for paper-based packaging, it's not a bad thing.

The question always ends up being, who pays for what. I think that's going to be more the issue over the longer run than any other consideration. As long as the handling of EPR is fair and the materials are treated in a way that does represent their total cost to the circularity or absence of it, I think we don't really have a problem. It's just making sure that everyone is operating on the same basis.

The risk, as I see it, in the U.S. is that it's not a federal movement. It's more like a state-by-state movement, and that may introduce biases and risks of unfair competition between the spaces from which you operate. But I'm not really concerned by EPR, per se, provided it is implemented in a uniform enough manner and that we don't get into trouble by unfair biases.

We've seen an extended period of weakness in corrugated following the pandemic. Is Smurfit Westrock altering its North American corrugated strategy in light of that?

Not really. Everything that is macro that is imposed onto us is not something on which we can act.

Our business has always been to adapt, making sure that through fluctuations and their spikes, as we've seen in COVID and post-COVID, that our core business is able to be flexible and to adapt to the necessities. But the core premise — across segments, across businesses, with the blend of national customers more local customers — is essentially the same, always.

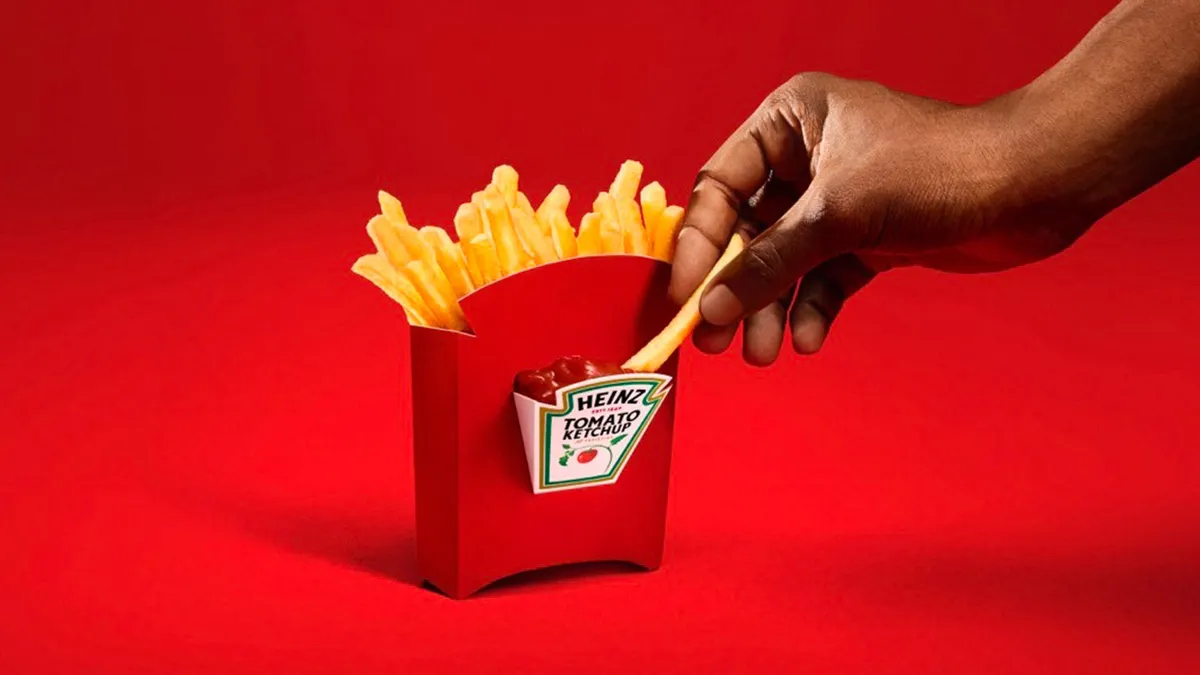

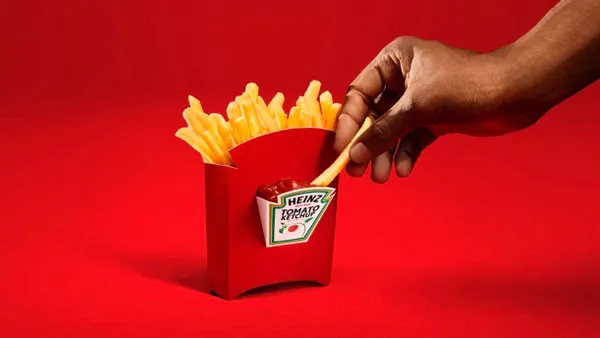

More importantly, it's focused on value in periods of softer consumption, like now, when lot of our brand owners and a lot of our clients are looking more than usual for creative solutions or innovation or ideas for how we can help them. Not to be only a packaging producer, but a provider of solutions so that they, in turn, lower their costs or enhance their image or become more visible on the shelf, etc.

So these periods usually allow us to be the better version of what we are traditionally, which is really be on the creative side and offer the market more than just a box.

You've been doing quite a few North American facility tours this year. Is that typical or is this a heightened engagement post-acquisition?

It's probably a combination of both.

I'm a basic boxmaker by origin. I'm one of those guys grown as general manager of mills, and so I'm not a great fan of PowerPoint presentations in an office. I don't understand it. I get bored. That is really not my stuff.

My stuff is to go in a plant, shake hands, go around the machines, talk to operators, talk to supervisors. Get a feel for what's happening there, and see all the things that you usually never see when you're off an office.

What is the network to get there? What's the proximity of industry, the type of customers that you can see? What's the dynamic at play? How does employment work in one particular place? All those things are very rarely covered in a presentation.

You're right: 2025 will probably stay in my personal records as an extreme period of mobility. But I really enjoy that, because it's only when you go to sites that you get to understand what your company is. And every time we go, we try and make sure that we meet with the customers as well. So it's not only inwards looking, but also outwards looking.

I confess that I really enjoy it. It's probably a very Smurfit Westrock way to do business. We like hands-on management.

One of the facilities you visited this summer is the new box plant in Pleasant Prairie, Wisconsin, which legacy leadership called a “superplant.” How are things going with the plans for a network of superplants?

I think “super” is actually an understatement. I think it's more like a megaplant. It beats anything in terms of dimensions: the breadth of it, the scale of it, the power behind it. It's the biggest lineup of machines I've ever seen in any place, and it's a fabulous facility.

It's also targeting the Chicago market, which is a very complex market and a very, very challenging market from a competitive standpoint. I think it was the right thing to do in that place. We were very piecemeal with a lot of smaller presence, none of which were really at the right level to be able to fight with the right tools in that market. So these are really great tools in the system.

We have more of those: We have one in Longview, Washington, which is more or less along the same lines. And there are a number of more intermediate sizes of box plants. But by and large, what we need to make sure is that we have tools that are suitable for the final target.

If you're addressing a high volume, low complexity, very transactional type of customer base, then you need to be equipped with top-notch equipment to be able to churn enormous amounts of volume. But there's much more to corrugated than just high volume. There's plenty of spaces where we can offer to customers things that are different: more differentiated, more print oriented, more complex types of boxes, merchandising and display.

It's more about expertise. It's about design, it's about knowledge, it's about sales presence. Size will not necessarily determine how good you are for particular markets. My objective is not to have a huge network of only megaplants, because the only customer we would have is high-volume customers. And notoriously, they're not the ones where we necessarily make the biggest earnings.

On Smurfit Westrock's earnings calls over the past year, leadership often has seemed to be more complimentary of legacy Smurfit Kappa infrastructure, but a little more critical of legacy WestRock sites in North America. With your touring, what are you seeing with the North American infrastructure overall, and what are your plans in the next year?

I think there was a sense out there that the assets of WestRock were not necessarily great quality assets. Touring the facilities with Tony Smurfit, the CEO, and a number of my colleagues clearly has demonstrated the opposite.

Actually, the asset base of WestRock is very solid. There are obviously a lot of things to do and plenty of opportunities, but clearly there is a very solid asset foundation in the legacy WestRock part. In general terms, there's no disappointment at all. It's always been more about the approach to the market and the organization drive more so than anything else.

The funny thing, we had come together a month ago, where the top 60 or 70 people of the company came together. And one thing that was very striking is that no one really remembered who was coming from where. And that, for me, is the indication that that combination is really on good tracks. You will have considerations that will resonate back to the legacy constituents of the company. But by and large, I think we feel very proud to be part of the same company.

The amounts of energy and the amounts of alignment that we've managed to create in the company at large is really, really strong. I'm super proud of what we're doing in the U.S. There's fantastic teams, there's great assets, there's a gorgeous market — that is going through a difficult period, but fundamentally a world of opportunity everywhere.

What is something about your current role that you think many people don't know or understand, but you wish they did?

I think people always imagine that responsibility like this comes with authority, or the attributes of authority. The real thing is the intimate daily, hourly, never-stopping feeling of responsibility. That's something that never goes away.

We're moving. We're going from here to there and cutting a ribbon and whatever. It looks very nice. But the reality is — and I love the job because of it — is the weight on your shoulders and the responsibility for your 55,000 colleagues is there at every single second of the day and the night. You never disconnect from work, because work and life are so intertwined.

I don't know that people necessarily realize that this is the case. My colleagues in senior positions know exactly what I'm talking about. But for many people, they see more the shine, let's say, of the position, and less so the weight of the responsibility. And that's heavy. I love it, but it's heavy.

Correction: This article has been updated to reflect the correct number of Smurfit Westrock locations across North America.