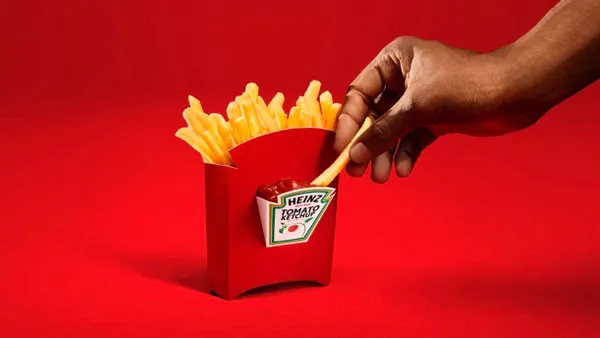

- Q2 results: Ball reported on Tuesday that global aluminum packaging shipments rose 4.1% in the second quarter. CEO Dan Fisher discussed higher-than-expected growth in North America in nonalcoholic beverages, including energy drinks. Still, margins were down in that segment. “We'll take the volume growth, and I think we just need to figure out how to more effectively and efficiently deliver that,” Fisher told analysts on an earnings call.

- Tariffs: Ball said in its earnings release that it views the direct impact from announced tariffs as “manageable” and is working with customers to mitigate effects from volatility in aluminum premium prices. “Our strategy emphasizes local sourcing and manufacturing, reducing our exposure to international trade fluctuations,” the company stated. Impacts from scrap metal pricing have been negligible, Fisher said on the call. “Candidly, we're more concerned about the demand side of tariffs in general, writ large, across the economy, than we are about any kind of isolated metal market at this point,” he said.

- Consumer trends: Ongoing promotional activity and multipack offerings are helping to drive sales among weaker consumers, particularly in the nonalcohol category. Grocery is also a stronger channel currently than convenience stores. Fisher reminded analysts that the can business is “recession-resistant, not inflation-resistant.” Higher input costs could cause all supply chain participants to struggle: “no one is going to be benefiting from that particular environment for a while if interest rates don't come down and things don't stabilize a bit.”

- Customer mix: Executives described some ongoing sluggishness in beer. “We had probably over-indexed into beer,” Fisher said. The company is pivoting a bit to lessen beer and grow other categories. “We've repositioned a little bit of that, and so we're starting to see the tailwinds of that. We'll continue to see the tailwinds of that into '26 and '27,” Fisher said.

- Capacity growth: Ball anticipates potentially running full out in all of its facilities in future months. “If we continue to grow at 5%, I think for the next 18, 24 months, we'll have to incrementally probably add a few lines here or there,” Fisher said. Ball noted a facility coming online soon in the Pacific Northwest, which it said should aid overall capacity. The company previously announced a two-line can plant in Oregon. Fisher also alluded to the addition this year of Florida Can Manufacturing as “a relief valve.” The company isn’t currently fully utilizing a facility in Monterrey, Mexico, so that could also provide extra production help, if needed.

- Outlook: “Our teams are committed to carefully navigating ongoing uncertainties and leveraging the resilience and strength of our global portfolio,” Fisher said. Executives now project a 12% to 15% increase in comparable diluted earnings per share in 2025. Looking ahead, more than 90% of Ball’s 2026 volumes in North America are already under contract, and about 75% is contracted for 2027 so far, executives said.

Ball optimistic after growth in nonalcoholic beverages

Meanwhile, the can manufacturer has been doing some “repositioning” of its beer-heavy portfolio, as that category has been relatively soft across geographies.

Recommended Reading

- Ball CFO to depart after less than 2 years in role By Katie Pyzyk • May 22, 2025

- Ball says tariff impacts so far have been minimal By Maria Rachal • May 7, 2025