State-level extended producer responsibility for packaging programs may be new in the United States, but they’ve already inspired a search for a more unified solution.

As more states pursue EPR individually and producer expenses mount, “there’s this very, very obvious need for harmonization on the federal level to help streamline the policies that we have in the states,” said Erin Simon, vice president of plastic waste and business at World Wildlife Fund.

One possible fix to growing state fragmentation on EPR would be action in Congress.

Just this week, packaging groups praised a new House bill aiming to bring unity to another disparate policy issue: labeling. But sources say that while EPR conversations and interest are circulating on Capitol Hill, it’s likely years before a bill would ever be introduced.

“All of that confusion is building up” around recycling policies across the U.S., said Danielle Waterfield, policy director at Ameripen, which could be a factor to push Congress to move in this direction, “but it's still a long way off.”

Building familiarity with EPR

The concept of a federal framework for packaging EPR got a moment in the spotlight in 2024, prior to any U.S. states actually implementing their programs.

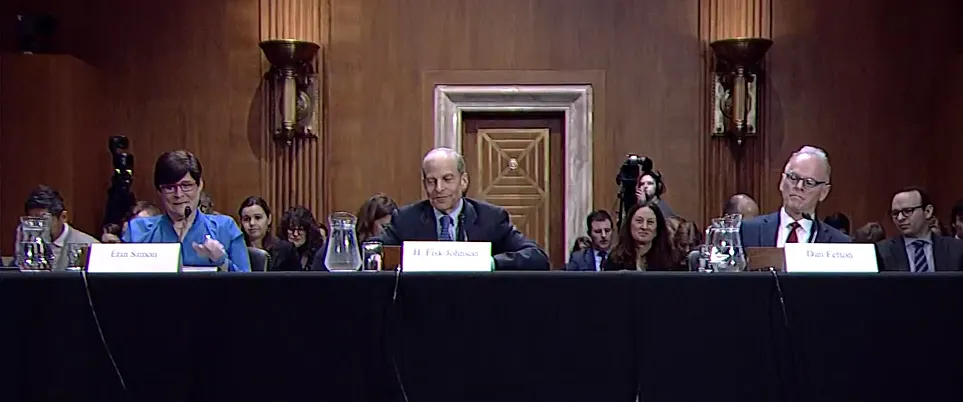

A Senate hearing held by the Environment and Public Works Committee featured testimony from leaders at environmental NGO World Wildlife Fund and consumer goods company SC Johnson who advocated for federal action, in part to avoid potential overregulation by states. Packaging trade group Ameripen also participated and said it would be willing to explore a federal approach, while also discussing cost concerns.

WWF’s Simon recently told Packaging Dive that because federal policy takes a long time to pass, the organization is also trying to focus on moving state actions forward and harmonizing those as they go.

In the time since last year’s hearing, additional states including Maryland, Minnesota and Washington have adopted packaging EPR laws. Business groups also raised more concerns during that period. This summer, the Department of Justice and National Economic Council sought public comments about state laws that “significantly burden commerce” in or between states. Some responses addressed extended producer responsibility for packaging.

The Flexible Packaging Association weighed in, saying that the fast and furious rise of varied state packaging EPR laws “has become problematic.”

“This complexity raises the cost of compliance without improving outcomes and creates barriers to interstate commerce due to the misalignment of schemes and conflict with the role of solid waste management” for the U.S. EPA under the Resource Conservation and Recovery Act, FPA wrote.

FPA ultimately concluded: “Federal intervention to drive EPR harmonization could support the goals of improving recycling while reducing the burden to interstate commerce.”

The National Association of Wholesaler-Distributors also responded, describing EPR laws as disruptive to nationwide distribution.

“The regulatory framework creates barriers to the free flow of packaged goods across state lines, which unduly burdens the operation of a market that routinely crosses state lines and characterized by national supply chains,” NAW asserted in its comments.

NAW sued Oregon regulators implementing the nation’s first-launched packaging EPR law, in part saying the law violates the federal dormant commerce clause, meant to protect against state laws that unduly burden interstate commerce. NAW sought a preliminary injunction in November to halt program implementation.

SC Johnson says it remains interested in a broader solution, per a recent statement to Packaging Dive.

“We are actively advocating for a federal EPR framework. EPR encourages innovation and investment in solutions to plastic waste,” the company said. “Just as important, a unified EPR approach — like federal EPR legislation in the United States or a global framework as part of a plastic treaty — helps ensure that the proliferation of local regulations doesn’t drive complexity, dysfunction, and cost.”

In the meantime, state laws have the potential to serve as a “laboratory” and offer more proof points as they play out, said Simon. Yet at the same time, “the lack of standardization makes it harder to implement as quickly,” which in turn may restrict results and make it more difficult to see improved recycling rates.

WWF will continue to focus on gradually educating lawmakers about the fundamentals of EPR, Simon said. The organization worked with the House Oceans Caucus to convene a briefing this month about how Congress can learn from the seven states to date with packaging EPR laws to inform potential harmonized EPR solutions on a national scale.

Watching other federal legislation for signals

So where exactly does sentiment stand now around a potential federal EPR framework? “That'll be the million-dollar question I think nowadays, maybe a billion,” Ameripen’s Waterfield said.

WWF is playing the long game on legislator education and simultaneously advancing complementary recycling solutions are priorities, Simon said.

WWF is also focusing on bills that have gotten bipartisan support this year, namely the Steward Act and the Circle Act, which aim to fund recycling investments in different ways. These can “facilitate the changes to existing waste management and recycling systems that will improve recycling and serve as a foundation for future EPR policies down the line,” Simon said.

One litmus test for a federal EPR framework could be the newly introduced Packaging Claims and Knowledge Act, which is “associated with many of the factors that are being incorporated into EPR,” said Waterfield. The Ameripen-backed legislation aims to harmonize standards for recyclable, compostable and reusable claims on consumer packaging.

“If we could potentially see Congress enact the PACK Act in the next year, it could be a very good bellwether on what the appetite is,” Waterfield said.