Dive Brief:

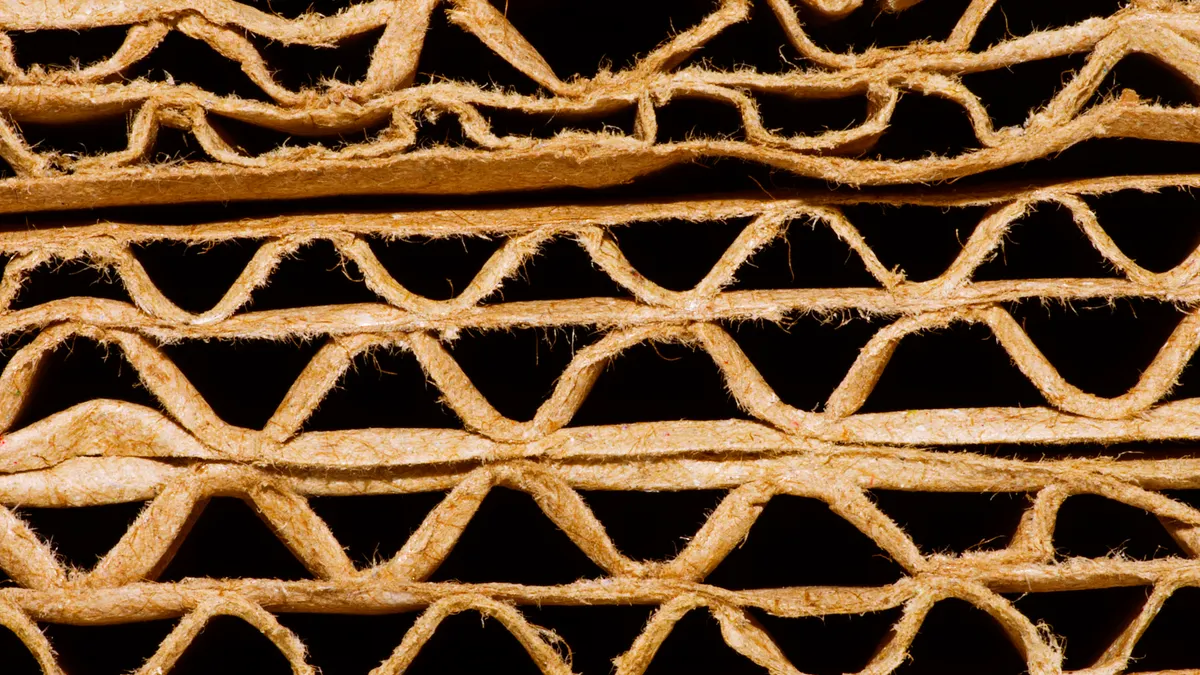

- Packaging Corporation of America issued letters to customers noting a $70 per ton price increase for containerboard slated to go into effect March 1, according to a memo released Friday by Green Markets, a Bloomberg company.

- This is the first major containerboard company to make a price increase announcement this year. Analysts had broadly expected the majors to raise prices in 2026, after a pause on price hike announcements for this category since late 2024.

- While various analysts noted that Cascades announced in December its intention to raise prices by $50 a ton in January, that was solely for corrugating medium.

Dive Insight:

The containerboard sector had a rough ride in 2025, with demand decreases playing into closures that resulted in an approximately 10% loss of North American production capacity. The last of those closures is set for next month, and the full impact to the industry should be realized at that time.

Already in the past couple months, the capacity cuts have resulted in producers’ operating rates ticking up into the low 90s, with multiple analysts projecting mid-90s this year. That fueled predictions for containerboard price hikes in 2026.

Michael Roxland, senior paper and packaging analyst at Truist Securities, told Packaging Dive during an early January interview that he expected at least the first containerboard price increase announcement to occur by February.

“Now that capacity has been adjusted, if you get at least some seasonal improvement in demand, that could help lend credence to why a price increase makes sense,” he said.

Justifications for price increases in 2026 will likely “lean less on operating rates and more on structural cost pressures,” according to a recent Green Markets memo, citing a nearly 50% increase in real hourly wages for corrugated box plant employees in the past five years.

“Rising energy costs, health insurance premiums, wage inflation and capital-equipment expenses should take center stage,” said the memo. It also mentioned that any containerboard price increases “would be primarily aimed at halting the erosion in box pricing amid sustained demand weakness.”

Truist’s Roxland noted that Cascades’ increase announcement did come first in December, but only for medium. However, as North America’s sixth-largest containerboard producer, Cascades’ moves sometimes aren’t as impactful unless larger producers join in with similar increases. For instance, when the company announced its third price increase of 2024 to take effect in October that year, it wasn’t reflected in Fastmarkets RISI’s monthly data.

“Their market share is low, and they really need the larger guys to get on board regarding price increases to have any really significant change in the industry,” Roxland said.

North American containerboard producers didn’t try for price increases in 2025 beyond those that took hold early in the year after having been announced in late 2024. Most of the major producers announced two hikes for 2024, which followed about two years of no increases.

Meanwhile, movement continues behind the scenes on the containerboard price-fixing lawsuit that Artuso Pastry Foods Corp. brought in July 2025 against major producers including Cascades, Georgia-Pacific, Greif, International Paper, Packaging Corporation of America and Pratt Industries. Graphic Packaging International and Smurfit Westrock have since been dismissed from the case; however, the case still includes Smurfit Kappa and WestRock, the companies that preceded Smurfit Westrock before it formed via a merger in July 2024. All the defendants have filed for dismissal.